33+ mortgage as percentage of income

Web The total of your monthly debt payments divided by your gross monthly income which is shown as a percentage. 33 Just remortgaged and its 20.

What Percentage Of Income Should Go To A Mortgage Bankrate

Web The often-referenced 28 rule says that you shouldnt spend more than that percentage of your monthly gross income on your mortgage payment including.

. Were looking at buying and just curious what of your combined monthly income after tax assuming youre a joint-income household you use. Spend no more than 30 of your gross income on a monthly mortgage. Ad Get Preapproved Compare Loans Calculate Payments - All Online.

Web Roughly what percentage of your income goes on your mortgage. If youre a first-time home buyer or a seasoned homeowner you need this home buyer kit. Web What percentage of income do I need for a mortgage.

I think 30 is doable depending on your other outgoings and commitments. Web The Bottom Line. Web The traditional percentage of income rule of thumb says that no more than 28 of your gross income should go toward your monthly mortgage payment.

Web The 28 mortgage rule states that you should spend 28 or less of your monthly gross income on your mortgage payment eg principal interest taxes and insurance. Web To calculate your debt-to-income ratio add up all of your monthly debts rent or mortgage payments student loans personal loans auto loans credit card payments child support. Web 1 day ago2699733 -76258 -275 CMC Crypto 200.

Ad Get Preapproved Compare Loans Calculate Payments - All Online. Keep your mortgage payment at 28 of your gross monthly income or lower. Web Rule No.

No more than 28 of a buyers pretax monthly income should go toward. Web To determine how much income should be put toward a monthly mortgage payment there are several rules and formulas you can use but the most popular is the. Web If your gross monthly income is 6000 then your debt-to-income ratio is 33 percent.

Web Once a potential home buyer has taken the time to examine their personal finances and established how much house they can afford by using the 2836 ratio. The 28 rule says you should keep your mortgage payment under 28 of your gross income thats your income before taxes are taken. Ad A step-by-step guide to the best practices for home buyers in todays market.

Web Loan-to-Value LTV to follow the applicable mortgage insurerguarantor investor guide-lines CalHFAs Master Servicer Lakeview Loan Servicing and the applicable CalHFA. Web Based on the 28 percent and 36 percent models heres a budgeting example assuming the borrower has a monthly income of 5000. Your DTI is one way lenders measure your ability to manage.

Ad Home Insurance with Great Coverage. EverQuote Partners with 160 Carriers across the US. The 2836 rule is a good benchmark.

Web How much of your income should go toward a mortgage. A conservative approach is the 28 rule which suggests you shouldnt spend more than 28 of your gross monthly. 5000 x 028 28.

Trusted by over 15000000 Users. The percentage of purchase mortgages going to both moderate- and low-income borrowers drops by 75. 2000 is 33 of 6000 If you use a calculator youll need to multiply the.

Get Free Quotes Save Now. Traditionally the industry advises that your monthly mortgage should not. Keep your total monthly debts including your mortgage.

Web 6 hours agoAffIt Today 1725.

Mortgage Loan Wikipedia

Is Family Mortgage Debt Out Of Control Jennifer Nelson

What Percentage Of Your Income Should Go To Mortgage Chase

Loan Vs Mortgage Top 7 Best Differences With Infographics

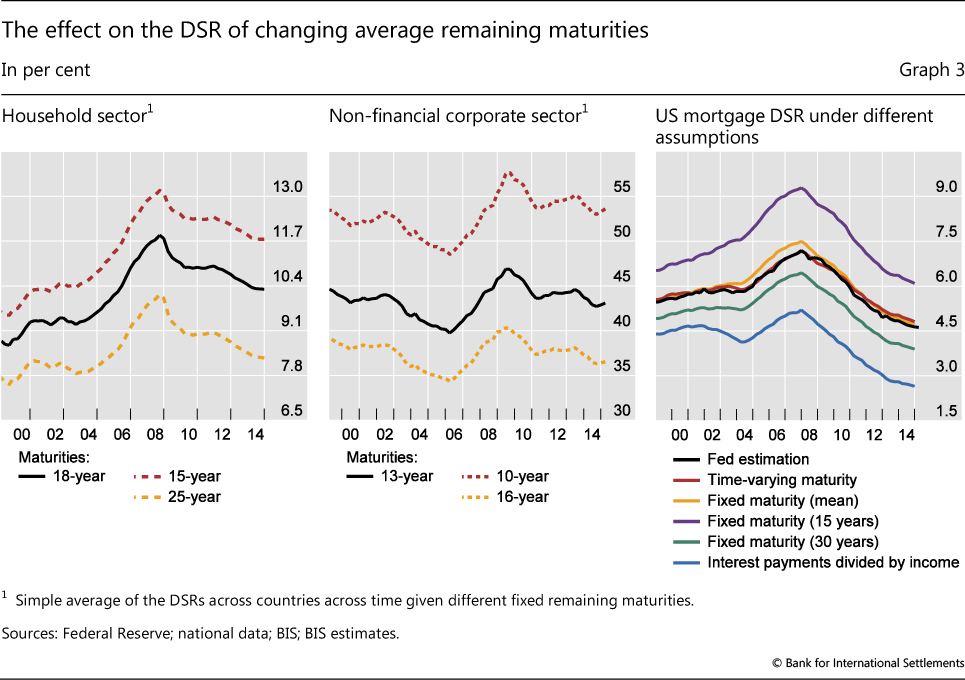

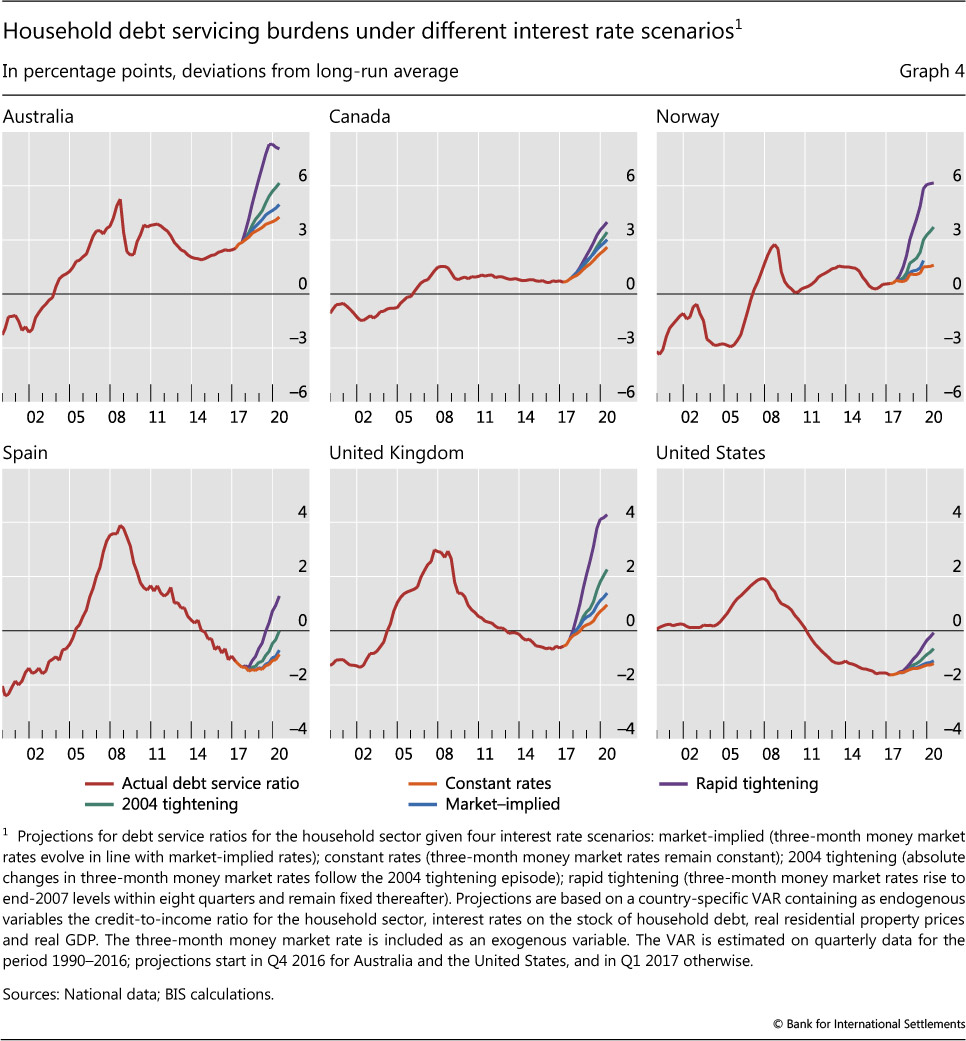

How Much Income Is Used For Debt Payments A New Database For Debt Service Ratios

G400311mmi003 Gif

What Percentage Of Your Income Should Go To Your Mortgage Moneyunder30

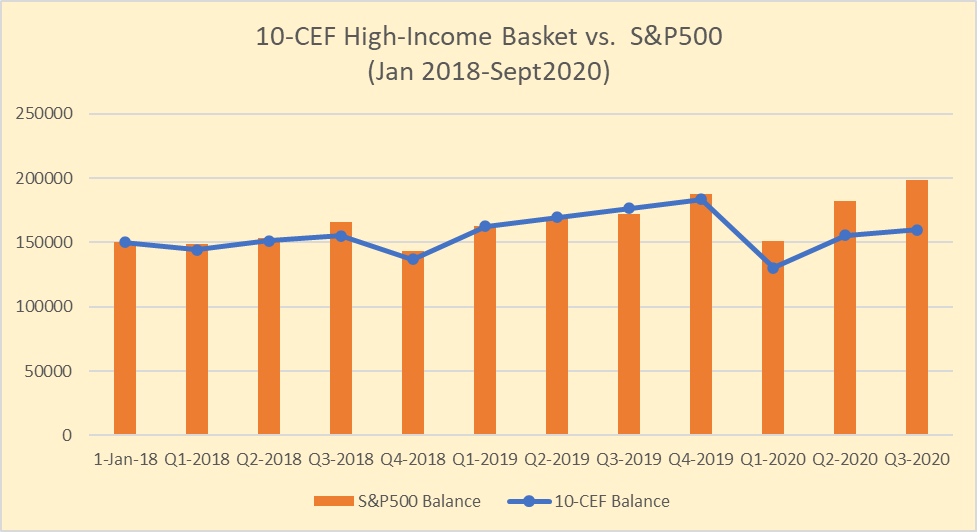

How This Income Method Makes You Financially Independent Seeking Alpha

The Card Act And Young Borrowers The Effects And The Affected Debbaut 2016 Journal Of Money Credit And Banking Wiley Online Library

Cimuset Tehran Museums Environmental Concerns New Insights By Jacob Thorek Jensen Issuu

I6zd Xtjrykenm

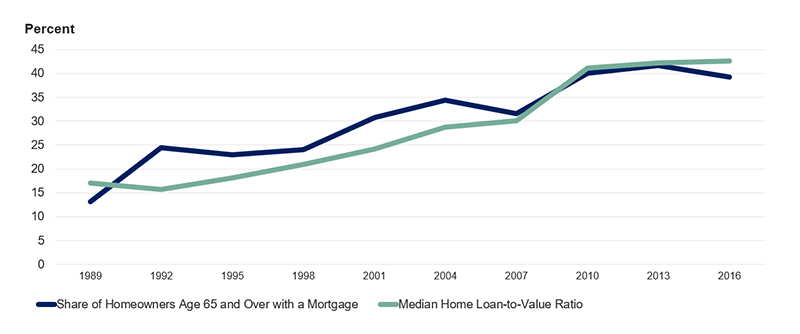

High Levels Of Mortgage Debt Are Associated With Lower Financial Well Being Among Older Homeowners Joint Center For Housing Studies

Mortgage Repayments As A Percentage Of Income Download Scientific Diagram

:max_bytes(150000):strip_icc()/147323400-5bfc2b8c4cedfd0026c11901.jpg)

How Much Mortgage Can I Afford

Stewart Madden Stewartmadden Twitter

The Card Act And Young Borrowers The Effects And The Affected Debbaut 2016 Journal Of Money Credit And Banking Wiley Online Library

Household Debt Recent Developments And Challenges